LDK - LDK Solar - Base & Break; JASO - Ja Solar Holdings - Symmetrical Triangle

Here's the LDK daily chart.

Here's the LDK Base & Break trade.

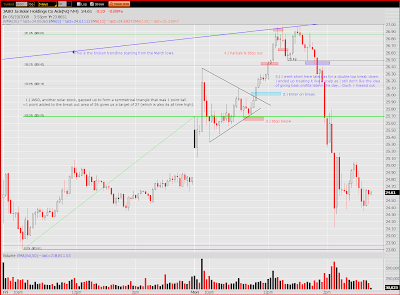

Here's the JASO 15 minute chart from the March lows until today.

Here's JASO's day trade.

JASO was also a HCPG newsletter pick last night through $26.00.

I still have that desire to bail on my late day trades, even if they are solid setups.

I left plenty of $$ on the table on a symmetrical triangle breakdown in ACI at about the same time I bailed on my JASO short.

Oh well. Still managed my longs in JASO & LDK fairly well.

I'll be looking to possibly add LDK on a pull back as a swing trade, depending on how the market and the rest of the solars are acting. FSLR (still the solar leader IMO), started to break down ahead of the other solar stocks today. It was not only a clue that the market may reverse, but that the solar sector may reverse.

HCPG also had quite a few triggers from last nights (DVN, SLB, RGLD, CMP, ACI, CMG) newsletter. I pretty much focused on the solar sector. The only one I really got a piece of is the SLB swing trade I added through 106 (possible cup & handle on the daily chart?). I closed it out as it began to reverse with the market later in the day.

I believe today's late day market reversal on heavy volume, is the 3rd one in recent weeks. I'm definitely getting more and more cautious on the long side with each of these reversals.

Keep an eye on the Tech, Transports, Materials & Energy sectors. They are the sectors that have basically pushed the market higher to the current levels. If they begin to reverse harder, they will drag the market lower. Financials, and other sector haven't really done much recently.

I'll have more on that later. Time to run some errands.

I liked JASO trade, clean, simple.. couldn't get more money on that trade than this :)

Solar sector is doing well lately, but we have to be careful about a reversal as you have said.

Tomer said... May 19, 2008 at 1:58 PM

Thanks Tomer :)

Trader M.D. said... May 19, 2008 at 8:59 PM

Post a Comment